The movement to end plastic pollution and ban single-use plastic packaging has become one of the most visible globally.

Despite this, the banking sectors’ role in funding plastic has not been investigated – until now.

Between January 2015 and September 2019, banks provided loans and underwriting of more than USD 1.7 trillion.

These loans went to 40 major companies involved in the global plastics supply chain, equivalent to USD 790 million per day.

More than 60 per cent of all finance identified was provided by ten banks, and more than 80 per cent (USD 1.4 trillion) came from just 20 banks.

| BANK | HQ | LOANS AND UNDERWRITING | % OF TOTAL |

|---|---|---|---|

| Bank of America | United States | 171,737 | 10.31% |

| Citigroup | United States | 145,816 | 8.76% |

| JPMorgan Chase | United States | 143,766 | 8.63% |

| Barclays | United Kingdom | 117,923 | 7.08% |

| Goldman Sachs | United States | 97,042 | 5.83% |

| HSBC | United Kingdom | 96,201 | 5.78% |

| Deutsche Bank | Germany | 77,398 | 4.65% |

| Wells Fargo | United States | 74,121 | 4.45% |

| BNP Paribas | France | 55,852 | 3.35% |

| Morgan Stanley | United States | 54,211 | 3.26% |

| Mizuho Financial | Japan | 50,602 | 3.04% |

| Mitsubishi UFJ Financial | Japan | 43,587 | 2.62% |

| Credit Suisse | Switzerland | 40,218 | 2.42% |

| Société Générale | France | 35,775 | 2.15% |

| Santander | Spain | 33,960 | 2.04% |

| SMBC Group | Japan | 33,189 | 1.99% |

| ING Group | Netherlands | 31,084 | 1.87% |

| Toronto-Dominion Bank | Canada | 23,574 | 1.42% |

| NatWest | United Kingdom | 22,207 | 1.33% |

| Royal Bank of Canada | Canada | 21,760 | 1.31% |

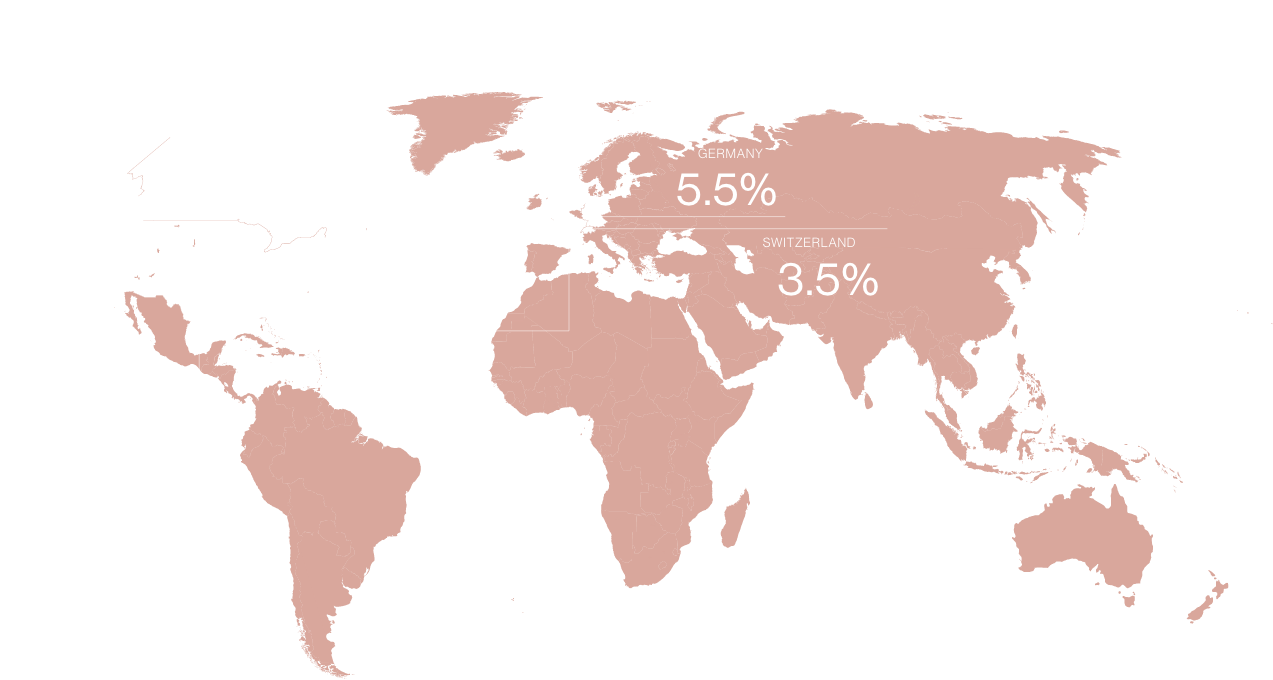

Meanwhile, more than 90 per cent of the total finance came from banks headquartered in just eight countries.

What next?

Despite public outcry over the serious consequences of plastic pollution, none of the 20 banks providing the bulk of funding have developed any due diligence systems, contingent loan criteria, or financing exclusions when it comes to the plastics industry.

In order to address global plastic pollution, banks and governments will need to play a much more active role to lay the groundwork for a circular economy and significantly reduce single-use plastic packaging.